Greater Seattle Area, WA's Premier Mortgage Provid

Find Your Perfect Home Loan in Greater Seattle Area, WA

Expert mortgage solutions tailored to Greater Seattle Area, WA’s unique real

estate market. Get personalized service, competitive rates, and

local expertise all in one place.

Excellent 5 out of 5

[#1] Rated

In Greater Seattle Area, WA Customer Satisfaction

Fast Approvals

Pre-approval in as little as 24hrs

Local Experts

20+ years in Greater Seattle Area market

Personalized Service

Tailored mortgage solutions

Want a personalized rate comparison?

OUR SOLUTIONS

Greater Seattle Area, WA Mortgage Services Tailored to Your Needs

First-Time Home Buyers

Specialized programs and guidance for first-time homebuyers in the Greater Seattle Area, WA market. We'll help you navigate the process with confidence.

- Low down payment options (as little as 3%)

- First-time homebuyer grants and programs

- Step-by-step guidance through the entire process

Refinancing Options

Lower your monthly payments, reduce your term, or tap into your home's equity with our competitive refinancing solutions.

- Rate-and-term refinancing to lower payments

- Rate-and-term refinancing to lower payments

- Low down payment options (as little as 3%)

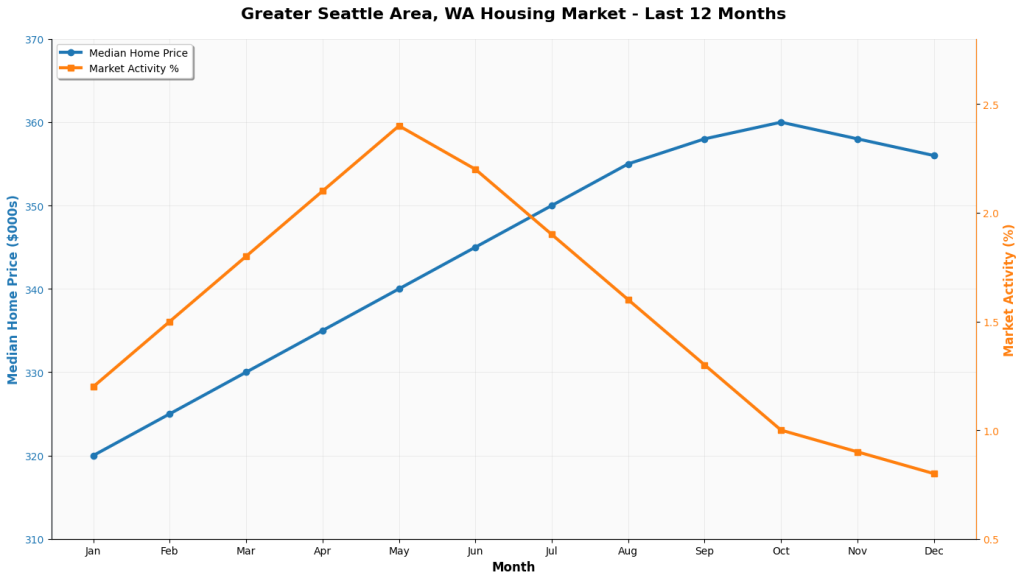

Greater Seattle Area, WA Housing Market Trends

Greater Seattle Area, WA Community Highlights

Thriving Economy

Greater Seattle boasts a robust job market with a 4.1–4.3% unemployment rate, below the national average. Major employers include Amazon, Microsoft, and Boeing, contributing to stable property values and sustained housing demand — ideal for those working with a trusted mortgage lender.

Popular Neighborhoods

- Ballard – Median price: $875,000, popular for families

- Capitol Hill – Median price: $950,000, upscale amenities

- Rainier Valley – Median price: $675,000, emerging area

Education

Home to the Seattle Public Schools district with several A-rated schools, and the University of Washington, making it an attractive location for families and increasing demand for housing in specific neighborhoods.

SIMPLE & TRANSPARENT

Our Greater Seattle Area, WA Mortgage Process

We’ve streamlined the mortgage process to make it easy and stress-free for Greater Seattle Area, WA homebuyers.

Initial Consultation

We'll discuss your financial goals, review your situation, and explore mortgage options specific to the Greater Seattle Area, WA.

Pre-Approval

Get a verified pre-approval letter that gives you an edge in the Greater Seattle Area, WA's competitive market.

Home Selection

Work with local realtors to find your perfect home while we stand ready to adjust your financing options.

Final Approval & Closing

We handle the paperwork and coordinate with all parties to ensure a smooth closing process.

What to Expect: Timeline

Day 1 Application submission and document collection

Days 2-3 Pre-approval issuance (subject to verification)

Days 4-25 Home shopping with your realtor

Days 26-35 Property appraisal and final underwriting

Days 36-45 Clear to close and final closing day

SIMPLE & TRANSPARENT

Our Greater Seattle Area, WA Mortgage Process

We’ve streamlined the mortgage process to make it easy and stress-free for Greater Seattle Area, WA homebuyers.

Local Market Expertise

20+ years of experience in the Great Seattle real estate market. We understand local property values, neighborhood trends, and regional lending requirements.

- Specialized knowledge of Greater Seattle housing trends

- Connections with local appraisers and inspectors

Competitive Rates & Programs

Access to exclusive mortgage programs and competitive rates tailored for [LOCATION] homebuyers, including first- time buyer incentives.

- Special rates for [LOCATION] residents

- Flexible down payment options from 0-20%

Personalized Service

Lower your monthly payments, reduce your term, or tap into your home's equity with our competitive refinancing solutions.

- Rate-and-term refinancing to lower payments

- Rate-and-term refinancing to lower payments

- Low down payment options (as little as 3%)

What to Expect: Timeline

Ready to Explore Your Greater Seattle Area, WA Mortgage Options?

SIMPLE & TRANSPARENT

Our Greater Seattle Area, WA Mortgage Process

We’ve streamlined the mortgage process to make it easy and stress-free for Greater Seattle Area, WA homebuyers.

Posted onTrustindex verifies that the original source of the review is Google. Steve Tytler met with me personally as a 'walk in' loan applicant five years ago. He treated me as if I was the most important person in the world at the time. Our loan rate for our first home was impressively low. Steve contacts us by both email and personal telephone calls probably twice each year and offers to answer any mortgage questions we light have. The personal touch, along with the nice Christmas cards (hand signed, not machine signed) are, also, a nice touch. In all, we are impressed with the personal service and care for us, as I am a disabled veteran, and continued interest in my family's well being. I doubt we could either ask for or find better service. And, finally, we went to Steve Tytler and Best mortgage after hearing their ads for several years on KVI radio 570 in Seattle. It was a good recommendation by Kirby Wilbur on KVI, and we have been served very well.Posted onTrustindex verifies that the original source of the review is Google. Best Mortgage refinanced our home about three and a half years ago. Our experience with their team was outstanding! They covered the entire process end-to-end and made it exceptionally straightforward and easy, all the way to the point at which we signed all of the paperwork (they brought it to our home and walked us in detail through each document). They continue to provide assistance and guidance to us years after, even on non-mortgage questions (like generally about real estate, or other services), and they still occasionally reach-out to us just to keep in touch and see if there's anything else we need. I highly recommend Best Mortgage and will engage with them if we ever need a new mortgage or another refinance.Posted onTrustindex verifies that the original source of the review is Google. You can really call yourself the best, but it doesn't seem like the best idea, but Best Mortgage IS THE BEST! YES YES YES Steve Got involved himself every time there was a potential snag and he navigated us through the rough water. Not only Steve but Best Mortgage's amazing staff like Lisa could handle it all, and they all did an amazing job. But when someone had the day off or was away on honeymoon, Steve handled work by himself over the weekend. Steve Got us through the VA home loan process, which is a bit tougher than a conventional Loan, but Steve also got us the absolute best interest rate possible. I can recommend Best Mortgage as the Best company I've ever dealt with. Their concern and tenacity for our family home is what I wish every company would have, except for a mortgage company because I will only ever recommend Best Mortgage.Posted onTrustindex verifies that the original source of the review is Google. Steven and his team are very professional, prompt and a pleasure to work withPosted onTrustindex verifies that the original source of the review is Google. If anyone is looking for a real honest and super helpful person to work with Steve is the one. He will not try and get you into something that is not right for you but will give you great advice.Posted onTrustindex verifies that the original source of the review is Google. Steve Tytler and his team at Best Mortgage are great! Very helpful through the whole process. This was our first time doing a refi into a VA loan and it went off without a hitch. It really is like doing business with a friend of the family. Highly recommended!

COMMON QUESTIONS

Mortgage FAQ

What is the difference between a fixed-rate and an adjustable-rate mortgage?

How do I know how much I can borrow?

What documents do I need to apply for a mortgage?

How long does the mortgage approval process take?

What's the minimum credit score needed for a mortgage?

What's the difference between pre-qualification and pre-approval?

LOCAL AREAS

Greater Seattle Area, WA Neighborhood Guide

NEIGHBORHOOD 1

offers spacious homes with yards, excellent schools, and a strong community atmosphere. Median home prices range from $350,000 to $450,000.

Popular Home Types: Single-family homes, townhouses

Avg. Price per Sq Ft: $185

School Rating: 8/10

NEIGHBORHOOD 2

An upscale area with luxury homes, premium shopping, and fine dining. [NEIGHBORHOOD 2] features modern developments with top-tier amenities. Home prices typically start at $500,000.

Popular Home Types: Luxury condos, custom homes

Avg. Price per Sq Ft: $275

Commute to Downtown: 15 minutes

NEIGHBORHOOD 3

A revitalized area that's gaining popularity among first-time homebuyers and investors offers great value with median home prices around $275,000 to $325,000.

Popular Home Types: Starter homes, duplexes

Avg. Price per Sq Ft: $155

Growth Potential: High

GET IN TOUCH

Contact Our Greater Seattle Area, WA Mortgage Team

Have questions or ready to start your mortgage journey? Our local experts are here to help.